Best Same-Day Business Loans Of 2024

Business owners who need fast access to cash can benefit from the accelerated approval and funding times available with same-day business loans. However, high interest rates and short repayment terms can make these loans more expensive than traditional financing. These are the best same-day business loans you can use in a pinch.

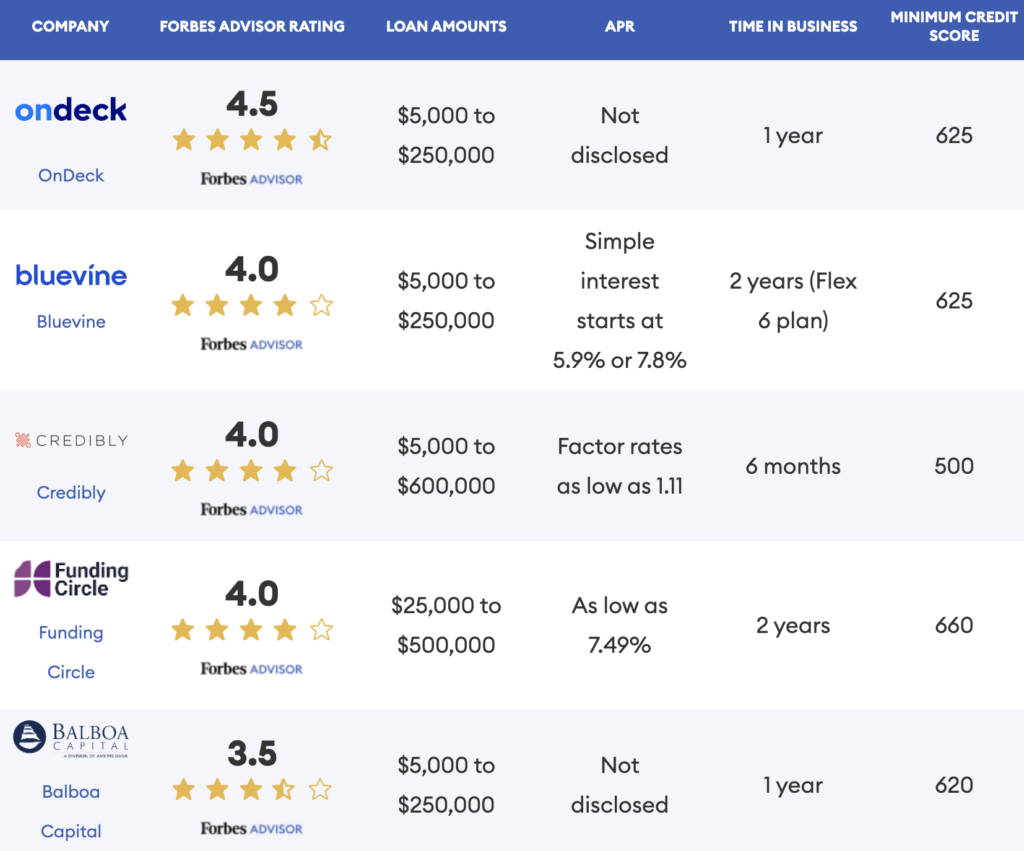

This is Best Same-day Business Loans of June 2024

On Deck

Loan amounts: 5000$ ~25000$

APR range: Not disclosed

Minimum Credit Score: 625

Editor’s Take: We picked OnDeck for its variety of business lending products and same-day funding. OnDeck offers a term loan from $5,000 to $250,000 with repayments terms of up to 24 months. You can also access a credit limit of $6,000 to $100,000 through its line of credit with a 12-month repayment term that resets after each withdrawal.

Pros:

– Term loans from $5,000 to $250,000

– Lines of credit from $6,000 to $100,000

– Same-day funding

– Low minimum credit score requirement

Cons:

– $100,000 minimum annual revenue requirement

– Must have been operating for at least one year

– Does not lend to businesses in North Dakota

Details:

Eligibility

-Minimum credit score: 625

-Time in business: One year

-Minimum revenue: $100,000 per year

Turnaround time

You can apply and receive a decision from OnDeck on the same day.

Expert’s Take:

OnDeck has carved a niche in the realm of alternative lending, offering expedited access to capital for businesses that may not qualify for traditional bank loans. Its big advantage is the availability of funds on the same day or next while not being affected by a hard credit pull. However, this aggressive lending practice also comes at a steep price.

Bluevine

Loan amounts: $5,000 to $250,000

APR range: Simple interest starts at 5.9% or 7.8%

Minimum Credit Score: 625

Editor’s Take:

Bluevine is a financial technology company that provides financing solutions to small businesses nationwide. It specializes in business lines of credit and checking accounts. As of December 2021, Bluevine no longer offers invoice factoring as one of its financing methods.

Small business owners looking to access a line of credit on an as-needed basis can receive funds from $5,000 to $250,000. Bluevine offers two payment structures: Flex 6 or Flex 12. Customers who choose Flex 6 make weekly payments over 26 weeks while Flex 12 customers make monthly payments over 12 months. What’s more, after 45 days of payment on Flex 6, or 90 days of payment on Flex 12, you may be eligible for a credit line increase.

Bluevine also charges weekly or monthly fees for its line of credit. Standard pricing is 1.7% per week or 7% per month for line of credit draws.

Note: Bluevine’s line of credit is available in most U.S. states except Nevada, North Dakota, South Dakota, Puerto Rico and other U.S. territories.

Pros:

Receive a decision within five minutes and instant funding with a Bluevine business checking account, or receive funds within 24 hours

Lines of credit up to $250,000

Low credit score requirement

Cons:

No mobile app for its line of credit

Monthly revenue requirement

Not available to businesses in Nevada, North Dakota, South Dakota, Puerto Rico and other U.S. territories

Details

Eligibility

Eligibility varies on the specific program a business owner chooses.

Weekly plan

Minimum credit score: 625

Time in business: Two years

Minimum revenue: $40,000 monthly or $480,000 annually

Business type: Corporation or LLC

Bankruptcies: No past bankruptcies

Monthly plan

Minimum credit score: 650

Time in business: Three years

Minimum revenue: $80,000 per month or $960,000 annually

Business type: Corporation or LLC

Turnaround time

After you submit your application, you can receive a decision in as quickly as five minutes and instant funding with a Bluevine business checking account. Borrowers who don’t have a Bluevine business checking account can receive funds within 24 hours.

Expert’s Take:

Bluevine appeared in a search we did for clients during the mini-banking crisis of 2023. Bluevine offers a bank sweep program that will provide FDIC insurance to their clients for up to $3 Million. FDIC insurance usually doesn’t matter, but when banks start failing, it really matters.

Credibly

Loan amounts: $5,000 to $600,000

APR range: Factor rates as low as 1.11

Minimum Credit Score: 500

Editor’s Take:

Credibly is an online lending platform that supports both small and medium-sized businesses. It offers a wide variety of same-day business loans, including working capital loans, lines of credit, merchant cash advances and long-term loans.

While terms range depending on the specific loan type, business owners can access financing from $5,000 to $600,000 . Each loan through Credibly offers same-day funding, helping business owners receive their funds quickly.

Pros:

Wide variety of loan products

Low credit score requirement

Fast funding times

Cons:

Lowest loan amount is $5,000

Requires daily or weekly payments

Details:

Eligibility:

Minimum credit score: 500

Time in business: At least six months

Minimum revenue: At least $15,000 in average monthly bank deposits

Turnaround time:

Credibly offers same-day approvals and same-day funding once approved.

Funding Circle

Loan amounts:$25,000 to $500,000

APR range:As low as 7.49%

Minimum Credit Score: 660

Editor’s Take:

Funding Circle has been a direct lender specializing in small business loans since 2010. It has helped 135,000 businesses in 700 industries and lent $20.2 billion globally. We chose Funding Circle because it provides fast, affordable loans with a simple application process and funding in as little as 48 hours. Prospective borrowers have three options: business term loan, line of credit or SBA loan.

Funding Circle term loans range from $25,000 to $500,000 with repayment terms from six months to five years. If you choose to apply for a business line of credit, you can access credit lines between $6,000 and $100,000. However, Funding Circle doesn’t specify its line of credit repayment terms. You can also apply for Funding Circle SBA loans, which range from $25,000 to $500,000 with terms up to 10 years.

There is one main drawback of Funding Circle: There’s a one-time origination fee on each loan ranging from 3.49% to 6.99% of the approved loan amount.

Pros:

Loans from $25,000 to $500,000

Funding in as little as 48 hours

No minimum annual revenue requirement for most loans

Cons:

One-time origination fee between 3.49% to 6.99% of the approved loan amount

Requires two years in business, so it’s not ideal for startups

Not available to Nevada businesses

Details

Eligibility

Minimum credit score: 660 for most loans; 650 for SBA loans

Time in business: Two years

Minimum revenue: None for most loans; $400,000 per year for SBA loans

Turnaround time

Depending on the loan type, you can receive your funds within two days. However, SBA loan funding may take up to two weeks.

Expert’s Take

Funding Circle provides long-term loans that are essential for businesses planning significant investments in growth or infrastructure. The clear terms and lower interest rates compared to short-term loans make this an excellent choice for businesses with a stable financial outlook and a strategic long-term development plan.

Balboa Capital

Loan amounts: $5,000 to $250,000

APR range: Not disclosed

Minimum Credit Score: 620

Editor’s Take

Balboa Capital makes small business funding simple. Prospective borrowers are able to compare its various options, apply in minutes and, if approved, receive their funds as soon as the same day as approval.

Business owners can apply for a variety of business financing, including small business loans and equipment financing. Small business loans range from $5,000 to $250,000 while equipment financing tops out at $500,000. Commercial, vendor and franchise financing is also available with terms of $350,000 or $500,000, depending on the specific financing and collateral.

Pros & Cons:

Pros

Loans from $5,000 to $250,000

Online application with quick funding

May qualify with just a year in business

Cons

$300,000 annual revenue requirement

Not suited for new businesses

Details

Eligibility

Minimum credit score: 620

Time in business: At least one year

Minimum annual revenue: $300,000

Turnaround time

In some cases, you may be able to apply and get funding within the same day.

Summary: Best Instant Business Loans:

Methodology

We reviewed 15 popular lenders based on 16 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We chose the best lenders that offer same-day funding based on the weighting assigned to each category:

Loan cost: 35%

Loan details: 25%

Customer experience: 20%

Eligibility and accessibility: 10%

Application process: 10%

Within each major category, we considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit score and time in business requirements and the geographic availability of the lender. Finally, we evaluated each provider’s customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

Where appropriate, we awarded partial points depending on how well a lender met each criterion.

To learn more about how Forbes Advisor rates lenders, and our editorial process, check out our Loans Rating & Review Methodology.

Tips for Comparing Same-day Business Loans

Consider these tips to choose the best small business loans with fast funding:

- Find a loan that meets your budget and borrowing needs. Same-day funding may sound appealing, but it’s often more costly than traditional loans. Evaluate your business’ needs to determine whether fast funding is necessary and whether the elevated monthly payments will fit within your budget.

- Review each lender’s application requirements. Getting same-day funding requires submitting a complete application that can be reviewed and approved quickly. Choose a lender with accessible application requirements that can be met without additional communications or extensive paperwork.

- Take time to review the lender’s reputation and reviews. Read online reviews for each lender before committing to a loan. This can help identify any red flags like difficult lending standards, high interest rates and poor customer service.

- Avoid fees, where possible. Most same-day lenders charge high interest rates and fees to make up for fast funding, short repayment terms and the additional risk posed by more lenient qualification requirements. If possible, opt for a lender that offers low- or no-fee business loans with fast funding.

What Is a Same-day Business Loan?

A same-day business loan is a type of financing that lets business owners quickly access money to cover operating costs and other expenses. In general, a business owner can access funds within 24 hours of applying—or as soon as the same day.

Same-day business loans can provide fast access to cash without meeting the rigorous lending standards imposed by traditional lenders. However, this convenience comes with higher borrowing costs, including interest rates from 4% to around 99% or higher, plus origination fees

When To Get a Same-day Business Loan

Same-day business loans are a great way to access cash quickly, but they can be expensive and difficult to pay off. That said, this type of financing may be the only option available for new businesses and applicants with poor credit. A same-day business loan may be a good fit for:

- Businesses that need to finance short-term cash flow issues

- Startups with no credit history and limited financial records

- Borrowers who don’t meet eligibility requirements for traditional loans

- Business owners who need cash quickly to take advantage of an opportunity

Types of Same-day Business Loans

Consider one of these types of business loans if you need money fast:

Short-term Loan

Short-term loans let borrowers access a lump sum of cash and then make monthly payments for a set repayment period. In general, short-term loans feature repayment terms between three and 18 months. Rates can range anywhere from 3% to more than 50%, and interest begins accruing on the entire loan balance as soon as funds are disbursed.

As with some other same-day loans, the combination of short repayment terms and high interest rates may result in high monthly payments.

Business Line of Credit

A business line of credit lets borrowers access funds on an as-needed basis, up to a set borrowing limit. Rates are typically between 10% and 99%, and interest only accrues on the portion of the line of credit the borrower has accessed.

Borrowers also can pay off their balance and reuse their funds for the duration of the draw period—usually between 12 to 24 months. This means that a business line of credit can cover ongoing costs without having to pay interest on more money than is actually needed.

Merchant Cash Advance

A merchant cash advance (MCA) is a type of financing businesses can use to quickly access cash without meeting traditional qualification and application requirements. Under this type of financing, a business owner receives a lump sum of cash that is collateralized by a portion of future sales receipts.

Factor rates generally range from 1.2 to 1.5, which is equivalent to annual percentage rates (APRs) between 40% and 350%—much higher than many other forms of business financing. Loans are repaid from the business’ daily credit card sales or via daily or weekly automatic clearing house (ACH) payments.

For that reason, MCAs may be a good fit for businesses with a high volume of sales to cover payments.

Invoice Financing

Invoice financing lets borrowers secure a business loan with a portion of the business’ outstanding invoices—generally between 80% and 90%. The business remains responsible for collection, and when the client pays the invoice the borrower repays the loan, plus fees and interest.

Interest typically accrues at a rate of 1% to 3% per month, with APRs shaking out between 10% and 79%. Invoice financing can be expensive, but it lets businesses access cash quickly and without meeting traditional qualification requirements.

Business Credit Cards

Business credit cards give businesses access to a revolving line of credit that can be used to cover operating costs, purchase office supplies and equipment and address other day-to-day cash flow issues. APRs range from about 13% to 35%, but borrowers with excellent credit may qualify for a card with a 0% introductory rate.

This type of financing also may come with almost immediate approval, and borrowers may be able to use the account before receiving a physical card.

Pros and Cons of Same-Day Business Loans

For some business owners, a same-day loan may be the best—or only—way to get the cash they need to cover operating expenses.

Pros

- Often come with more accessible eligibility requirements.

- Less rigorous application process than traditional business loans.

Cons

- Higher APRs and origination fees

- High monthly payments

How to Get a Same-day Business Loan

The process of getting a business loan varies by lender, but there are a few steps borrowers should take to get fast access to funds. Here’s how to apply for a same-day business loan:

- Determine your timeline. Before applying for a same-day loan, evaluate yourborrowing needs to determine whether same-day funding is necessary. While some business owners may find themselves in need of immediate, emergency funding, it’s best to avoid this type of financing when possible.

- Check your credit score. Check your credit score before choosing a lender so you can compare lenders with accessible qualification requirements. Some lenders only require a credit score of 500 to qualify for same-day financing, but many require a FICO score of at least 600. And, while these requirements vary, borrowers with higher credit scores qualify for more competitive interest rates.

- Compare lenders. After determining which lenders you’re likely to qualify with, compare offerings to identify the best fit for your borrowing needs. This should include a comparison of interest rates, loan amounts and terms, fees and reviews from current and previous borrowers. Also, consider each lender’s minimum qualification requirements like time in business and annual revenue.

- Prepare documents. The exact documents necessary to apply for business financing vary by the loan type and lender. Same-day lenders may impose less comprehensive application requirements than other financial institutions, but most still require information about annual revenue and existing financing.

- Submit a formal application. Once you identify the best lender or lending platform for your needs, submit a formal application. Most same-day lenders let prospective borrowers apply online without having to visit a branch in person. However, if your application is incomplete the lender may contact you via phone or email to request additional documents or information.

While same-day business loans stand out because of their fast funding times, the amount of time it takes money to arrive ultimately depends on the borrower’s bank. If you’re tight on time, check with your financial institution to determine how long funds will take to clear your business’ account.

Can You Get a Same-Day Business Loan With Bad Credit?

You can get a same-day business loan with bad credit, but it’s not common. Whether or not you can get it in the same day depends on several factors, including the type of business loan you’re applying for and which lender you’re applying with.

You can get some types of business loans much faster than others. Certain SBA loans, for example, can take up to a month or more to process. On the other hand, loans such as merchant cash advances or invoice factoring commonly allow for same-day funding since they function differently from traditional term loans.

In addition, some lenders offer faster turnaround times than others. Online lenders offer same-day funding more often, although you’ll often pay a much higher price for these types of loans.

Frequently Asked Questions (FAQs)

What is same-day financing?

Same-day financing is a form of business funding that lets borrowers access cash on the same day they apply. These loans are sometimes referred to as emergency loans because they’re best reserved for situations where business owners need money faster than is possible with traditional forms of financing. This is because these loans often come with high APRs, origination fees and other fees that can increase the overall cost of borrowing.

Can you get a business loan with an LLC?

Borrowers who want to get a business loan as a limited liability company (LLC) should legally form the entity before applying for funds. An LLC’s loan application is more likely to be approved if the business can provide copies of its balance sheet, profit and loss report, cash flow statement and other relevant financial documents. So, prospective borrowers should also organize their business finances prior to submitting a loan application.

How quickly can I get an SBA loan?

Timing depends on the specific program, but U.S. Small Business Administration (SBA) loans generally take between 30 and 45 days from application to funding. That said, approval can take up to six months for some SBA loan programs, while SBA Express loans offer faster approval times between 24 and 36 hours and funding in as few as 30 days. Exact approval and funding times for SBA loans ultimately depend on the individual lender and the borrower’s bank.

Can you get a same-day business loan with no credit check?

You can get a same-day business loan with no credit check, but it’s not very common and it depends on a few details. You’ll need to find a lender that offers same-day business loans, and no-credit-check loans are more common with certain types of products like merchant cash advances or invoice factoring.

Is it difficult to qualify for an instant business loan?

No business loans are truly instant since it takes at least a few minutes, if not hours, of processing time. Even relatively fast funding options have some qualifications that may be easier or more difficult for you to meet, such as being a regular user of certain payment processing services.

PayPal Working Capital loans offer funding within a few minutes of being approved, for example, but you’ll need to meet minimum annual revenue requirements and be a regular business PayPal user.